What does an executor do in a Will — and how do you choose the right one?

By Chris Watts, Will Writer – Fern Wills & LPAs

Last verified: 10 September 2025 (England & Wales)

Quick-read summary

Choosing an executor is not just a formality, but one of the most crucial decisions in your Will. Executors, including you, carry out the deceased's wishes: they apply for probate, settle debts and taxes, and pass on the estate to the people you’ve chosen. Your role is pivotal in ensuring the deceased's wishes are carried out.

Pick someone you trust who is organised, has the time to do the job, and is comfortable communicating with banks, professionals, and family. In some families, a professional executor (alone or alongside a family member) reduces stress and avoids conflict.

Modern estates increasingly include digital assets (email, cloud accounts, photographs, subscriptions, cryptocurrency). Executors also need to identify and manage these. A brief conversation before you name someone helps everyone understand what’s involved.

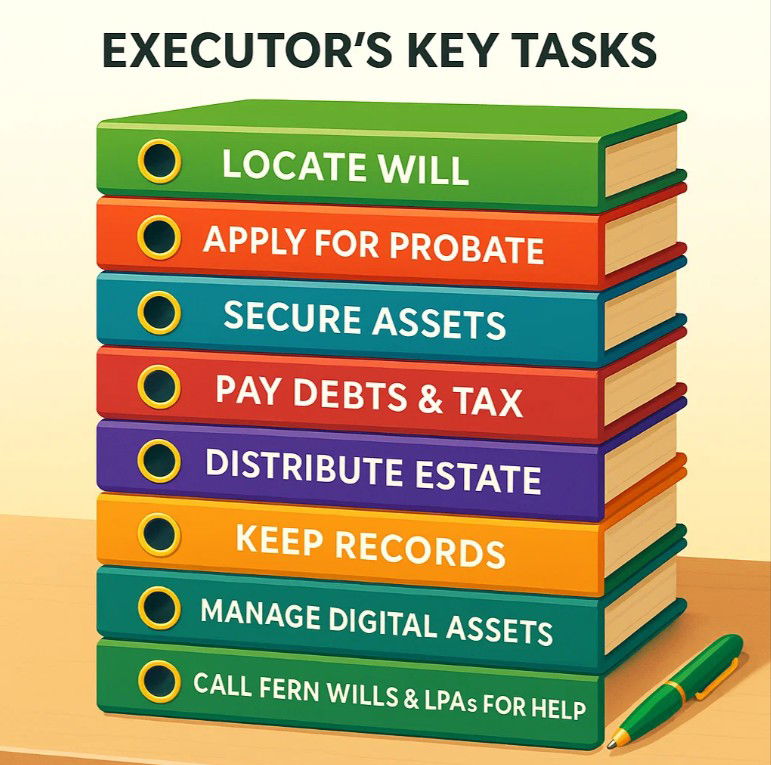

Practical checklist — what executors actually do

- Locate the latest Will and any codicils

- Apply for probate (or letters of administration if there’s no Will)

- Secure, collect and value estate assets

- Identify and pay estate liabilities and any tax due

- Distribute the estate in line with the Will

- Keep clear records and communicate with beneficiaries

- Identify and deal with digital assets (email, cloud storage, social media, online accounts, crypto, loyalty points)

Executors can be personally liable if they make mistakes. Choose carefully and make the role manageable for the person you pick.

What to consider when choosing your executor

- Trust & steadiness: calm, reliable, discreet

- Organisation: paperwork, deadlines, forms, follow-up

- Financial competence: comfortable with statements and balances

- Availability: time to progress the estate without long delays

- Digital awareness: estates now extend beyond paper files

- Communication style: able to liaise with banks, advisers and family

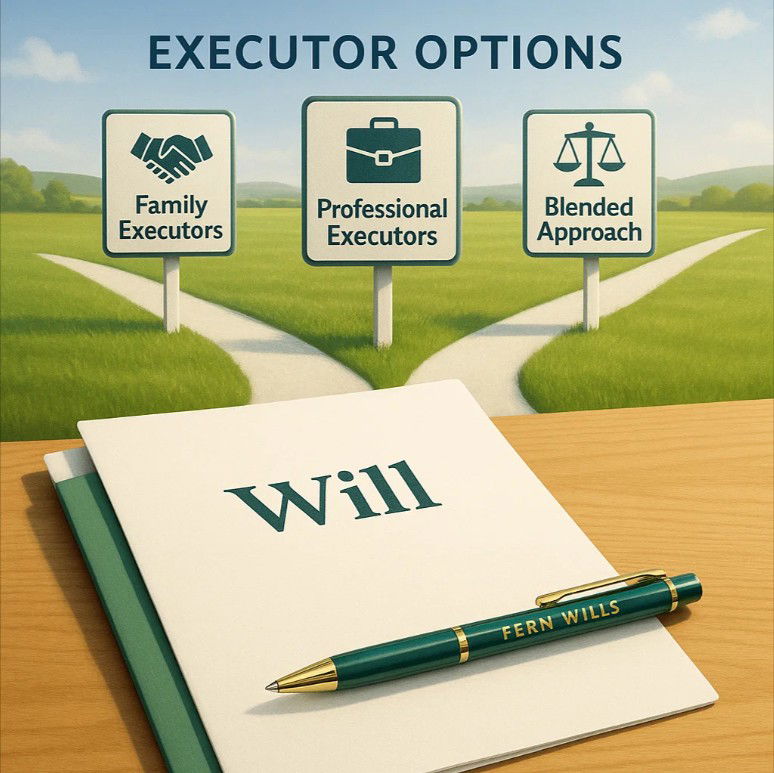

Family, friends, or a professional?

- Family or friends can work well when relationships are straightforward and someone has the time and temperament to do it.

- Professional executors (solicitor or trust professional) bring neutrality and process expertise but charge fees (often a fixed fee or a small percentage of the estate).

- Blended approach: naming one trusted family member plus a professional can combine trust, practicality and neutrality — helpful where there’s potential for friction.

What if my children are abroad or too busy to participate?

Some clients worry that their children live overseas or have demanding careers and won’t have the time to manage probate. In these situations, our advice is usually to appoint a trusted family member first — but to build in flexibility.

We can draft your Will so that your chosen executor has the option to bring in professional help if needed, on terms agreed at the time. That way, your family stay in control and isn’t tied to open-ended costs.

If you prefer, we can also name a professional executor as a reserve, to act only if the family are unable or unwilling to do so. And if support is needed, Fern Wills & LPAs can either assist directly or recommend a trusted partner.

This approach avoids “blank cheque” appointments, keeps choice in your family’s hands, and ensures support is available if and when it’s genuinely needed.

Should your Will-writer or solicitor act as executor?

Some providers — including both solicitors and will-writers — actively encourage clients to appoint them as executors or even as attorneys. On the face of it, this can look convenient: they already know your Will, and they stand ready to act.

At Fern Wills & LPAs, we take a clear stance:

But in reality, this creates a serious conflict of interest. We are aware of competitors who take this approach, and it guarantees them significant future earnings from your estate. While it may be tempting for the provider, we believe it is morally wrong to steer clients into arrangements that lock in future fees and limit family choice.

We will never write ourselves into your Will as your primary executor.

In our view, doing so is unfair to families and leaves costs open-ended at a time when they are most vulnerable.

Instead, our approach is:

- Family and friends first. Appoint those you trust personally, keeping costs low and the role within your circle of influence.

- Flexibility to bring in professionals. Executors can and should have the option to engage professional help if needed, on terms agreed upon at the time.

- Professional back-up only. If family executors are unable or unwilling to act, we support adding a professional executor as a named reserve. This ensures maximum security without locking families into unnecessary expense.

This gives you the best of both worlds: personal control and flexibility, with professional support available if required — but never forced upon you.

Talking to your chosen executor (before you name them)

Short, honest conversations prevent surprises:

- “I’m updating my Will and would like to ask if you’d feel comfortable acting as my executor. It involves applying for probate, settling finances and keeping the family updated. Does that feel manageable for you?” "The Will Writer can help or introduce you to accountants and probate services if you feel you want or need it."

Make it clear that they can decline now or reserve their right to step back later if circumstances change.

Co-executors, alternates and avoiding conflict

- You can appoint more than one executor. Two can work well — too many can slow things down.

- Always name at least one alternate in case your first choice can’t act.

- Be realistic about family dynamics. Two siblings who don’t get on can create a delay. A sibling plus a professional is sometimes the smoother option.

Illustrative alternate wording:

“If my spouse is unable or unwilling to act, I appoint [Full Name] of [Address] to act as alternate executor.”

Executors and digital assets

Executors now need to be prepared for more than paperwork and bank accounts. Increasingly, estates include:

- Email and cloud services

- Online subscriptions and app stores

- Social media accounts and memorialisation settings

- Digital photos, documents and domain names

- Cryptocurrency or online investment platforms

- Loyalty points, wallets and other virtual accounts

Practical tip: keep a separate, secure record of how to access key accounts (never publish passwords in the Will). Some families also choose to nominate a trusted person who can assist the executor in managing digital assets, even if they are not formally appointed.

For clients of Fern Wills & LPAs, our Assets Log provides a simple way to keep track of online and offline assets in one place — making life much easier for your executors.

How this works in real life

Cheryl— two siblings named together

Mrs Smith had named both daughters as joint executors to be “fair”. The sisters often clashed, and decisions stalled. We revised the Will to appoint the more organised daughter as executor with a professional as co-executor. Communication improved, probate moved faster, and the family relationship stayed intact.

David — the overloaded executor

David was flattered to be asked by his father, but he travels for work and was anxious about deadlines. We retained David as the primary executor but added his mother as an alternate and documented a straightforward handover plan. When a busy period hit, David stepped back, and the estate continued to move without delays.

Amir— well-meaning friend without probate experience

Mr Patel had been named because he was trusted, but he had never dealt with probate. After a straightforward conversation, the family appointed their accountant as co-executor. Mr Patel remained involved for family continuity, while the accountant handled forms, timelines and HMRC queries.

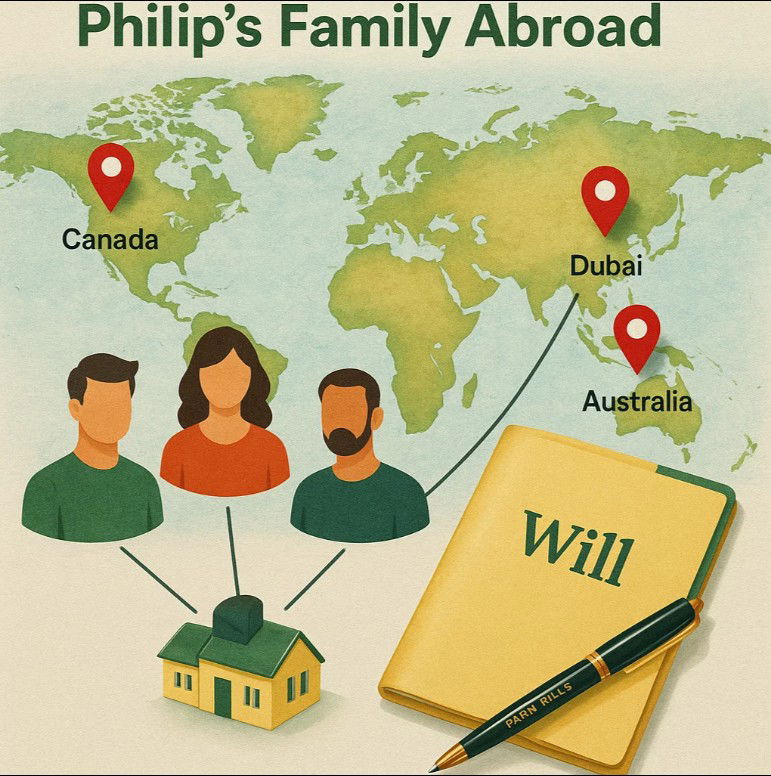

Philip — children living abroad

Philip had three adult children, all successful professionals working in Dubai, Australia and Canada. He didn’t want to burden them with executorship duties from overseas. We named his eldest as executor for family continuity. Still, we added flexibility: the Will included a clause allowing professional support if needed, and gave the option of naming a reserve professional. This left Philip reassured that his estate could be managed smoothly, while keeping costs and choices firmly under family control.

It isn’t about what looks fair on paper. It’s about what will work in practice when the time comes.

Can I refuse to be an executor?

Yes. You can renounce before probate or, in some situations, step back and let others act on your behalf.

What if there’s no Will?

An administrator is appointed, and the estate is administered according to the intestacy rules.

Do executors get paid?

Family executors typically don’t. Professionals charge either a fixed fee or a small percentage of the estate; clear quotes at the outset help avoid surprises.

Does my executor have to live nearby?

No, but distance can slow things. Naming a local alternate can help.

What about digital assets?

Executors should identify and manage online accounts and digital assets as part of the estate administration. Failing to recognise and value digital assets can lead to problems later.

Optional Technical Notes (for those who want the detail…)

- Executors derive powers and duties primarily from the Will and the Administration of Estates framework (England & Wales).

- Probate: often required where property is involved or institutions request a grant. Some small-balance accounts may release without a grant.

- Inheritance Tax: many estates are now “excepted estates” (no IHT due and no full IHT return). Estates that do need a return use IHT400 with the relevant schedules.

- Digital assets: treat as property to be identified, secured, and, where appropriate, valued. Platform terms may affect access and transfer of data.

Sources & further reading

- Gov.uk — Applying for probate

- MoneyHelper — Choosing your executor

- ICAEW — Guide for lay executors

- Fern Wills & LPAs — Assets Log (downloadable below: a practical tool for recording what you own, including digital accounts and online services)

Next steps

If you’re unsure who to appoint — or want a second pair of eyes on your current choice — let’s talk. We’ll assess your family situation, the complexity of your estate, and the practical realities, so you can choose with confidence.

- Book a Will MOT review with Fern Wills & LPAs

- Discuss family vs professional executors

- Sense-check digital assets and practicalities