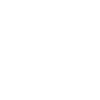

Trusts for Children and Young Persons

By Chris Watts, Private Client Consultant — Fern Wills & LPAs

Last verified: 10 October 2025 (England & Wales)

Quick-read summary

When leaving money to children or young beneficiaries, it’s vital to make sure their inheritance is protected until they’re ready to manage it. Different trusts keep funds safe, support responsible use, and reduce unnecessary tax.

At Fern Wills & LPAs, protecting vulnerable people is a shared duty for parents and professionals. Every Will we write for families with children under 18 automatically includes a bereaved minors’ trust — at no extra charge. Ethics come before profit.

A well-planned Will ensures that care, not chance, decides how a child’s inheritance is managed.

This page explains the main trust types for children and young adults, how trustees can use funds in real life, and the key tax rules behind them.

Practical checklist

- Confirm whether the beneficiary is your child or stepchild.

- Choose an age for full entitlement: 18 or up to 25.

- State the age condition clearly in your Will.

- Appoint trustees you trust and brief them on your wishes.

- Trustees can use funds for education, training, and welfare before full entitlement.

- Understand the tax position at 18 and between 18–25.

- Keep your Will updated if family circumstances change.

What to consider

- Eligibility: Bereaved trusts apply only to the testator’s legal child or stepchild.

- Age choice: 18 gives earlier control; up to 25 gives longer protection.

- Trustee powers: Trustees can use money to support the child before entitlement.

- Tax: Bereaved trusts have favourable Inheritance Tax (IHT) treatment compared with standard relevant property trusts.

- Safeguarding: Structure the Will so vulnerable beneficiaries are protected first.

Good Wills protect. Great Wills protect the most vulnerable first.

Bereaved Minors’ Trust (BMT)

A bereaved minors’ trust is created when a gift in a Will is made to the testator’s children on the condition that they attain 18. Only a child or stepchild of the deceased qualifies; gifts to other minors follow different trust rules.

Conditions for BMT status (section 71A of the Inheritance Tax Act 1984 (IHTA 1984)):

- At least one parent has died.

- The trust is created by that parent’s Will, on intestacy, or under the Criminal Injuries Compensation Scheme.

- The beneficiary becomes absolutely entitled no later than age 18.

- Any income or capital applied before 18 is for the minor’s benefit.

How it works

While under 18, trustees may apply income or capital for maintenance, education, or welfare, or pay it to a surviving parent or guardian to use for the child’s needs. At 18, the child becomes absolutely entitled to the trust assets.

Tax treatment

BMTs are not subject to the periodic or exit charges that apply to relevant property trusts. For Inheritance Tax (IHT) purposes, no IHT arises when the child becomes entitled at 18 or dies before 18. If a qualifying residential interest is held, the Residence Nil-Rate Band (RNRB) can apply.

Bereaved Young Persons’ Trust (BYPT)

Also called an 18–25 trust, this applies where a Will gives to children on condition they reach an age between 18 and 25.Conditions for BYPT status (section 71D of the IHTA 1984):

- At least one parent has died.

- The trust is created by that parent’s Will, on intestacy, or under the Criminal Injuries Compensation Scheme.

- The beneficiary becomes absolutely entitled no later than 25.

- Income and capital before 25 must be used for the young person’s benefit.

How it works

While under 25, trustees may apply income or capital for education, training, or welfare, or pay it to a parent or guardian to use for the young person’s needs. At the stated age (no later than 25) the beneficiary inherits absolutely.

Tax treatment

- No IHT charge when the beneficiary becomes entitled at or before 18, dies under 18, or the trust converts into a BMT while under 18.

- In other cases, an exit charge may apply when assets leave the trust while the beneficiary is 18–25. The charge is pro-rated by the number of full quarters since age 18 (or since trust creation if later), capped at 4.2% above the nil-rate band.

- No ten-year anniversary charges.

- RNRB can apply for a qualifying residential interest.

Other trusts for minors

Gifts to minors who are not the testator’s children or stepchildren — for example, grandchildren, nieces, or nephews — do not qualify as bereaved trusts. They usually form either a Bare Trust (beneficiary entitled at 18) or a Relevant Property Trust (entitlement delayed beyond 25). Relevant property trusts can attract ten-year and exit charges of up to 6%, so careful planning is needed when setting age conditions.

Trustee powers and practical support

Trustees have legal powers to help a young beneficiary while keeping funds safe. Under sections 31 and 32 of the Trustee Act 1925 (TA 1925), trustees can apply income and, where appropriate, advance capital before full entitlement.

Typical uses

- School or university fees, books, travel, equipment

- Vocational training or apprenticeships

- Essential living expenses and housing support

- Support for special needs or medical requirements

Under standard administrative clauses (STEP Provisions, Third Edition), trustees may transfer funds to a parent or guardian to spend for the child’s benefit.

How this works in real life

Trustees often have to decide when using money early is in the beneficiary’s best interests. The following stories show how these trusts work in practice and how thoughtful trustees can make a real difference.

Education — the school trip

When a 15-year-old pupil was invited on a residential school trip abroad, the cost was beyond the family’s reach. The trustees — the child’s uncle and aunt — used trust income to fund the trip after discussing it with the surviving parent. The payment came from the inheritance set aside for the child’s future, but everyone agreed it supported his education and development. The trustees had authority to do this without consent, yet chose to involve the family to reflect what the deceased parent would have wanted.

Training — the apprenticeship

A beneficiary under a young persons’ trust left school at 18 to start a plumbing apprenticeship. Trustees advanced a small amount of capital to buy essential tools and cover the first term of college fees. The decision was agreed between the trustees, who were close friends of the late parent, and the beneficiary. They saw it as using part of the future inheritance to build independence and opportunity.

Welfare — housing and stability

Another young adult, aged 19, found that the shared house they were due to move into for their exams fell through at the last minute. The trustees, after quick consultation, released part of the trust capital to cover temporary accommodation and living costs. The payment came from the pot that would otherwise have been received at 25, but everyone agreed it was in the beneficiary’s best interests and true to the parents’ intentions. Each of these decisions was recorded, justified against the trustees’ duties, and made with the beneficiary’s welfare at heart.

Unmarried partners

Bereaved trusts apply only where the beneficiary is the deceased’s legal child or stepchild. A gift to a partner’s child who is not your legal child or stepchild will not be a bereaved trust for tax purposes; it will usually fall under relevant property rules, with potential exit and anniversary charges. Planning is important for unmarried families.

Optional technical notes

- Bereaved Minors’ Trust: section 71A of the Inheritance Tax Act 1984 (IHTA 1984)

- Bereaved Young Persons’ Trust: section 71D of the IHTA 1984

- Trustee powers: sections 31–32 of the Trustee Act 1925 (TA 1925)

- BYPT exit charge: pro-rated by full quarters since 18; maximum 4.2% above the nil-rate band.

- STEP Provisions (Third Edition): commonly used administrative clauses.

Can grandparents set up a bereaved minors’ trust?

No. Only parents or step-parents can create one in their own Will.

What happens if the child dies before 18 or 25?

The assets pass under the parent’s Will, not through the child’s estate.

Can trustees use funds for school or housing costs?

Yes. Trustees can apply income or capital for education, training, and welfare.

Do unmarried partners qualify for these trusts?

Not unless the child is the deceased’s legal child or stepchild. Otherwise, different trust rules apply.

Is Inheritance Tax due on these trusts?

Bereaved trusts avoid the usual ten-year and most exit charges if the statutory conditions are met.

Next steps

Writing a Will is more than naming heirs. It is about protecting those who rely on you most. If you want to check that your Will provides properly for your children or young beneficiaries, contact Fern Wills & LPAs for expert, ethical guidance.