Life Interest Trust (LIT) – income now, clear inheritance later

Last verified: February 2026 (England & Wales)

Most couples don’t worry about “trust structures”. They worry about something much simpler:

“If one of us dies, I want the survivor to be comfortable — and I still want the children to inherit in the end.

”A Life Interest Trust (LIT) is one of the cleanest ways to do that. It creates a protected “between deaths” period where the survivor has security and income, while the eventual inheritance stays clearly mapped out for the next generation.

A Life Interest Trust keeps things steady between deaths — and still ends with a fixed, straightforward inheritance later.

![couple at a kitchen table with paperwork / tea mugs] (Warm, real-life feel)](https://files.cdn-files-a.com/uploads/8891852/normal_gi-698c7850762ba.jpg)

Quick-read summary

A Life Interest Trust (LIT):

- Is usually a Will trust (it starts on death, not during life).

- Gives the survivor (the life tenant) a right to income from the trust assets (and sometimes the right to live in a home held by the trust).

- Keeps the long-term inheritance on track for the ultimate beneficiaries (often children, including from previous relationships).

- Can offer some protection against sideways disinheritance and future insolvency because the trust assets are not simply gifted outright to the survivor.

- Is typically simpler than a Flexible Life Interest Trust (FLIT) because it usually ends with fixed shares on the second death.

Who this is for

A Life Interest Trust is often a good fit for:

- Couples who want the survivor to be financially secure but want the inheritance to pass clearly to children later.

- Families where most of the estate is in the residue (cash, investments, savings, sometimes a share of the home), not just the property.

- Blended families where fairness matters and you want to reduce the risk of “good intentions” drifting over time.

- People who want a structure that is protective, but not overloaded with moving parts.

What a Life Interest Trust actually is

In plain English, a Life Interest Trust is a trust that holds some or all of the estate and gives one person (usually the surviving spouse/partner) a life interest.

That life interest usually means:

- Income from the trust assets is paid to the life tenant (for life, or for a defined period), and

- When the life interest ends, the trust fund passes to the ultimate beneficiaries in the shares written in the Will.

Depending on how it’s drafted, trustees may also have controlled powers to use some capital for the survivor if needed (for example, health costs, adapting a home, or major repairs). This is one of the key design choices — it affects both flexibility and the strength of any protection.

The design question is simple: “How much freedom should the survivor have to use capital, not just income?”

How it works

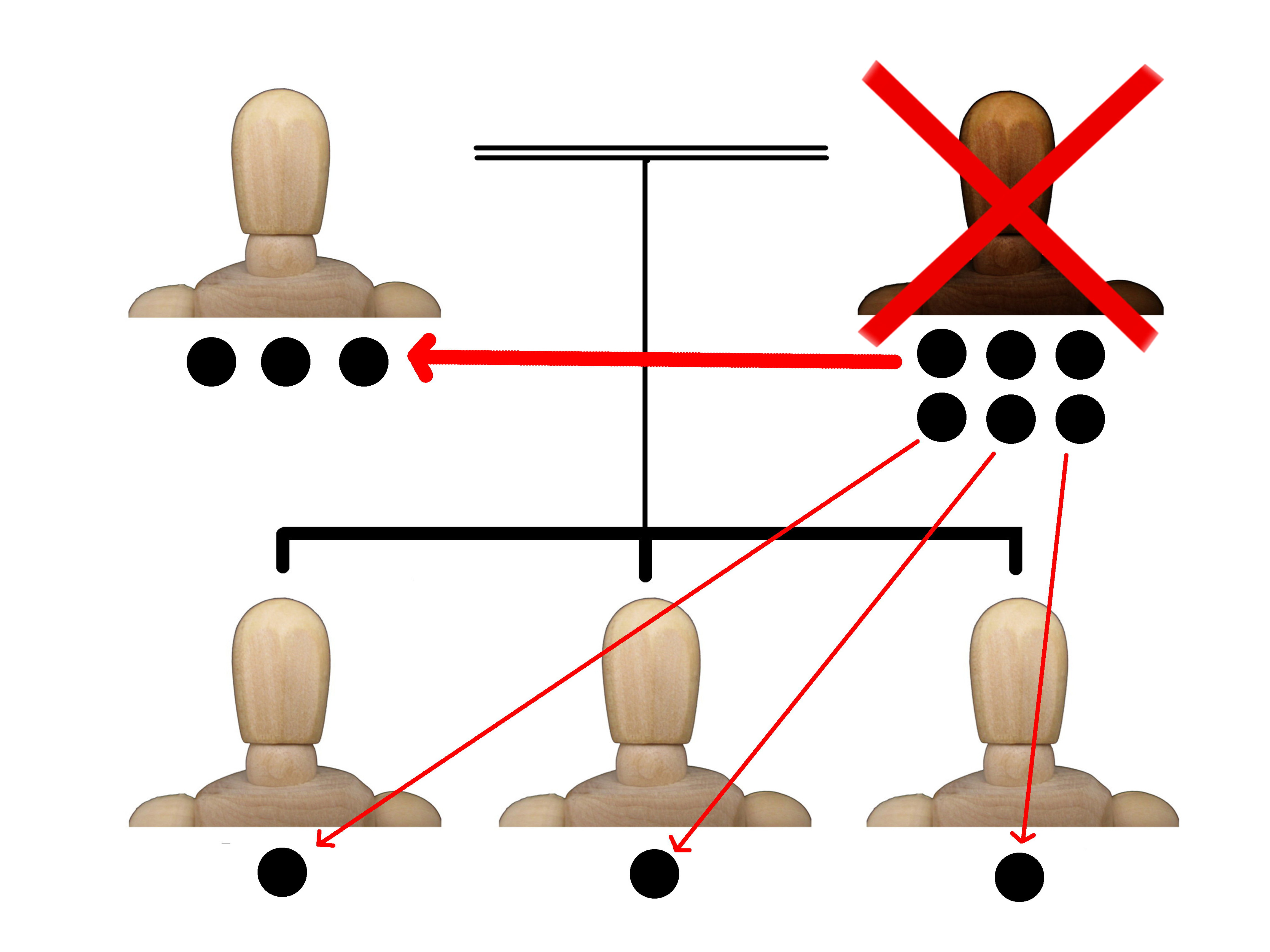

A typical Life Interest Trust works like this:

- First death

Your Will places the chosen assets into the Life Interest Trust (often the residue — “what’s left” after any gifts and expenses). - Between deaths

The survivor becomes the life tenant and receives income from the trust. Trustees manage investments, paperwork, and any big decisions. - Major decisions need trustee agreement

If the trust includes a property share, or if trustees need to sell, reinvest, lend, or release capital, trustees act together (sale, letting, and major transactions require trustee agreement). - Second death (or end of the life interest)

Whatever remains in the trust passes to the ultimate beneficiaries in fixed shares — clean and predictable.

Home ownership: a quiet detail that decides whether the plan can work

If a Will trust is going to control “your share of the home”, the legal ownership needs to allow that.

- Beneficial joint tenants

You both own the whole together. On the first death, the home usually passes automatically to the survivor outside the Will — so your Will trust cannot control “your half” because there is no separate half to follow the Will. - Tenants in common (50–50)

Each of you owns a defined share that can pass under your Will. This is the usual setup when your plan relies on a Will trust controlling a share on the first death.

If needed, this is normally dealt with by severance of tenancy (and a standard Form A restriction at HM Land Registry), so your Will and the title are aligned.

Related reading: Severance of Tenancy

How a LIT compares to PLIT and FLIT (in one minute)

Most families choosing between the three are really choosing where the trust “focus” sits:

- Property Life Interest Trust (PLIT) – mainly about the home and ensuring “no one loses their roof”.

Related reading: Property Life Interest Trust (PLIT) - Life Interest Trust (LIT) – usually focuses on the residue (income and clarity), and may include a share of the home if appropriate.

- Flexible Life Interest Trust (FLIT) – adds more tools and discretion, often including an extra discretionary layer.

Related reading: Flexible Life Interest Trust (FLIT)

If you want the bigger picture first: Choosing the Right Family Trust – PLIT, LIT and FLIT

What a LIT can (and can’t) protect against

A Life Interest Trust is not a magic shield. It’s a structured way to keep a fair plan steady over time.

It can help by:

- Reducing the risk of sideways disinheritance (for example, the survivor later remarries and rewrites their Will) because the trust assets are not simply transferred outright to the survivor.

- Offering some protection against future insolvency or pressure because trust assets are controlled by trustees and follow the trust rules.

- Keeping the inheritance “shape” clear: survivor supported first, beneficiaries inherit later.

Its limits:

- If the trust gives wide access to capital, protection may be weaker (because more value can be moved out during the survivor’s lifetime).

- It doesn’t remove family complexity — it simply manages it more calmly and predictably.

Care fees (important, but not the main reason most families choose a LIT)

Some people ask whether a Life Interest Trust “protects the estate from care fees”.

It may offer some protection in certain fact patterns, but it is never guaranteed and it must not be the main driver.

Planning primarily to avoid care fees is risky and can be treated as deliberate deprivation. Many clients are willing to pay a fair contribution and typically use Will trusts mainly for survivor protection and keeping inheritance on track; any care-fees impact should be a secondary consideration and is never guaranteed.

A note on trustees (because this is where plans succeed or fail)

A Life Interest Trust only works as well as the people running it.

In most families, trustees are:

- The survivor (often), plus at least one other person, or

- Trusted family/friends with the right temperament, or

- A combination of family and a professional trustee chosen independently by the family where complexity or conflict risk justifies it.

Trustees don’t “own” the assets for themselves — they manage them for the life tenant and the ultimate beneficiaries.

Optional technical notes (only if you want the outline)

- Many spouse/partner Life Interest Trusts are treated as an immediate post-death interest (IPDI) for inheritance tax purposes. In broad terms, the trust assets are often treated as part of the life tenant’s estate for IHT during the life interest. This is often about control and deferral, not making IHT disappear.

- Residence Nil Rate Band (RNRB): RNRB is usually easier to secure where the home (or its value) ends up closely inherited by direct descendants. Life-interest structures can be compatible, but the detail matters.

Related reading: Residence Nil Rate Band (RNRB): rules & how to claim - Capital Gains Tax: principal private residence relief is usually only relevant where a property is actually used as a main residence.

- Income tax: trust income is usually taxed on the life tenant as the person entitled, though trustees may have reporting duties depending on the setup.

- TRS: some Will trusts need registration on the Trust Registration Service depending on what assets are held and what happens after death.

- Land Registry: where a property share is held in trust, a Form A restriction is commonly used where the ownership is tenants in common.

For ethical and governance reasons, Fern Wills & LPAs does not take trustee appointments or create standalone lifetime trusts. However, Fern Wills & LPAs does create trusts that arise on death within Wills. Where a trust needs to be operated or registered, we will introduce you to an appropriate specialist to act and administer the trust. You remain free to choose your own adviser.

Cases

“Second marriage, calm support for the survivor, fixed inheritance for both sets of children”

James and Linda are married later in life. James has two adult children from his first marriage; Linda has one daughter. They get on well now, but everyone quietly worries about what happens if one parent dies first, and the survivor later rewrites their Will under pressure or simply “because it feels simpler at the time”.

With a Life Interest Trust, the survivor has income security from the residue and the ability to live normally without feeling watched. The ultimate beneficiaries are fixed in the Will, so the plan is not relying on memory, goodwill, or a future conversation that might never happen.

Without the trust, everything passes outright, and the inheritance for one side can quietly drift over years — especially after remarriage, a house move, or a change in family dynamics.

“Investments matter more than the house”

Ayesha and Rob own a modest home but have built up serious investments and cash savings over time. Their children are adults and financially sensible. Their priority is: “Who gets the income if one of us dies — and how do we keep it tidy?”

A Life Interest Trust is a natural fit. The survivor receives income from the invested pot, trustees keep the paperwork clean, and the children inherit in fixed shares later.

Without the trust, the survivor inherits outright and may later make informal gifts, change their Will, or mix assets in a way that creates confusion, resentment, or avoidable tax friction later.

“A trusted survivor… but a later relationship is the real risk”

Jane and Paul are in a long-term relationship and broadly trust each other. Their concern is not the survivor’s intentions — it’s what happens if the survivor later meets someone new and starts reorganising life, finances, and property in ways that unintentionally disadvantage the children.

A Life Interest Trust gives the survivor financial stability but keeps the inheritance map intact for the children. The survivor cannot accidentally “give away” what was meant to be preserved, because trustees control the trust fund under clear rules.

Without the trust, the plan depends on future decisions being consistent over decades, even when life changes.

“Adult children are fine, but one has a messy divorce history”

Gareth and Helen have two adult children. One is stable; the other has already been through one divorce and owns a small business with personal guarantees. Gareth and Helen want the survivor supported — but they want the inheritance to land safely.

A Life Interest Trust supports the survivor first and then passes wealth later in fixed shares. Alongside that, Gareth and Helen can use beneficiary-level planning (or a discretionary layer where appropriate) so the child at higher risk doesn’t receive everything in a vulnerable way at the worst possible time.

Without structured planning, a future inheritance can arrive at exactly the wrong moment and become exposed to claims or pressure.

“The home is jointly owned, but the ownership setup would have broken the plan”

Nina and Tom assume their Wills can control “their half of the house”. When we review the title, they are beneficial joint tenants — meaning the first death would pass automatically to the survivor and the Will trust would not bite.

We align things properly by moving to tenants in common (50–50) and then drafting the Life Interest Trust so the Will and the Land Registry title are pulling in the same direction.

Without that alignment, they could have had beautifully drafted documents that simply didn’t do what they thought in practice.

“Short-term inheritance coming in, and they want a steady ‘between deaths’ plan”

Chris and Deb are expecting a significant inheritance within the next year. They don’t want complicated long-term trustee management for the children, but they do want clarity: survivor supported first, then assets pass cleanly to the children.

A Life Interest Trust can be an elegant way to keep that future estate tidy. It reduces the chance of the inheritance becoming mixed, redirected, or unintentionally consumed in ways that derail the intended legacy.

Without a clear structure, later decisions can become reactive — and families can end up arguing about what was “meant” to happen.

Is a Life Interest Trust the same as a Property Life Interest Trust (PLIT)?

Not quite. A PLIT is usually focused on the home. A Life Interest Trust often focuses on the residue (cash and investments), though it can include a property share if appropriate.

Does the survivor get the money?

They usually get the income as of right. Access to capital depends on how the trust is drafted and what trustee powers are included. This is one of the main design choices we tailor to the family.

Can the survivor change who inherits?

Not in relation to the trust assets. That is one of the key benefits: the trust fund follows the Will terms, so it can’t be redirected by a later Will or a new relationship.

Do we need to change how we own our home?

Often, yes — if the plan relies on your share passing into a Will trust on first death. If you’re beneficial joint tenants, your share usually bypasses the Will and passes automatically to the survivor.

Related reading: Severance of Tenancy

Is a Life Interest Trust “better” than a Flexible Life Interest Trust (FLIT)?

Neither is “better” in isolation. A FLIT gives trustees more tools and flexibility, but it comes with more moving parts. A Life Interest Trust is often chosen where the family wants clarity and a clean end-point.

Related reading: Flexible Life Interest Trust (FLIT)

Will this avoid inheritance tax?

A Life Interest Trust is usually about control and protection first. The tax position depends on values, allowances, who benefits, and how assets flow between deaths. Where relevant, we plan with the Residence Nil Rate Band and the wider estate picture in mind.

Related reading: Residence Nil Rate Band (RNRB): rules & how to claim

Next steps

If you think a Life Interest Trust might fit your family, the easiest route is a short conversation to map what matters most (security, fairness, simplicity, flexibility), and then choose the best structure.

This article is general information only, not individual advice.